Manufacturing trends to watch in 2024: rising costs

Rising costs were a top challenge for manufacturers in 2023 — and this year looks to be no different.

Inflation caused prices to spike for not only materials, but wages and energy. And while inflation has cooled in recent months and prices have started to stabilize, the issue of how to mitigate high costs remains a key priority for companies at the start of the year.

This balance has been difficult for manufacturers, as low demand remained a consistent drag on the industry and has caused more companies to cut both supply and labor costs and lower production.

In budgeting for the year ahead, manufacturers are weighing stubbornly high material and labor costs with the need to keep up production capacity and remain competitive.

So what are the 2024 manufacturing trends when it comes to costs? We spoke with experts on what companies should expect regarding labor, materials and operational costs like IT and insurance.

Labor costs are likely to stay elevated, but turnover may ease

The cost of staffing factories is expected to keep climbing this year.

While manufacturing employment is expected to increase by 2% in 2024, wages and benefits costs are anticipated to rise by 5.2%, according to the Institute for Supply Management. That number is down from what manufacturers predicted for 2023 labor costs, which was 5.8%, according to ISM.

The downward tick is the result in part of easing inflation, said John Coykendall, vice chair of U.S. Industrial Products and Construction at Deloitte. In past years, a labor scarcity and high turnover rate drove costs up, reaching an average wage of $33.7 per hour in November, up 21% from January 2019, according to Coykendall.

But a cooling voluntary turnover rate has prompted optimism among employers that wages won’t increase as steeply this year.

"Five percent may seem high, but relative to some of the labor increases that we saw earlier in COVID, it’s actually a real moderation," Coykendall said.

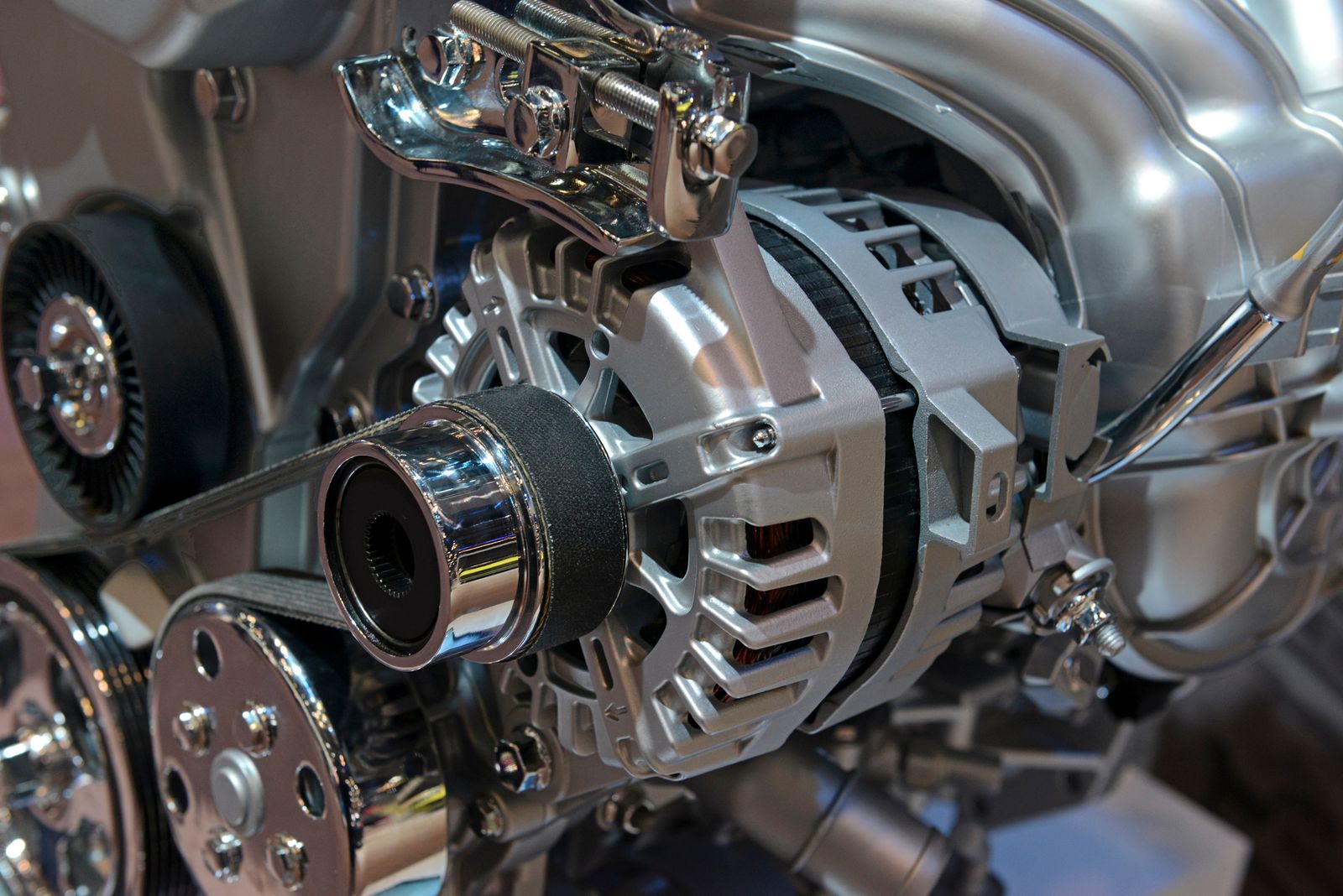

Supply prices are slowly moderating from inflation highs

Commodity and energy prices have remained a concern for manufacturers amid high inflation. Looking ahead into 2024, ISM forecasts that raw material prices will rise 3.2% during the first five months of the year.

That rise is an improvement from past years, said Tim Fiore, ISM's chair of its Manufacturing Business Survey Committee. Prices rose 4.1% in 2023 and have spiked a whopping 25% since 2020.

"We're going to continue to see price growth in the first half of 2024, and then it's going to stabilize and stay that way for the rest of the year," Fiore said.

Fiore noted he expects to see some decreases in commodity prices as the year progresses, but without large price swings previously seen in materials like steel and aluminum.

Lead times for getting supplies to factories are likely to continue improving amid normalizing supply chains. This fact should also help companies' bottom line, Coykenall noted.

"We're going to continue to see price growth in the first half of 2024, and then it's going to stabilize and stay that way for the rest of the year."

Timothy Fiore

Chair, Institute for Supply Management’s Manufacturing Business Survey Committee

While lead times peaked at an average of 100 days during the pandemic, Coykendall said as of August 2023, they'd fallen back down to 87, showing a positive trend.

"Time is money, and the longer it takes to receive parts, the longer it takes to do the production, you're inevitably going to see costs coming up," Coykendall said.

Manufacturers should get ahead on cybersecurity costs

A key manufacturing operations area in which experts say companies need to up their budget in 2024 is cybersecurity infrastructure.

Data breaches cost an average of $4.47 million for manufacturers and other industrial industries such as chemical and engineering firms in 2022, up 5.4% from the prior year, according to IBM. At the same time, nearly half of critical manufacturers face a significant risk of a data breach.

And as the threat and costs of cyberattacks in supply chain-related industries continues to rise, manufacturers need to take precautions to protect their operations, said Aaron Tantleff, a partner in Foley and Lardner's technology transactions, cybersecurity and privacy practice.

Tantleff encouraged manufacturers to increase their spending in 2024 to secure their tech infrastructure and employees' devices. The industry, he said, has lagged behind others when it comes to investing in cybersecurity.

One of the top spending priorities for the year should be to upgrade security features on all needed devices, Tantleff said, ensuring they are equipped with industrial-grade cybersecurity features. Spending plans should also include "patching" any cybersecurity holes in a company's network on a more frequent basis.

"The larger the number of devices that are added to the environment, the greater your attack surface vector is," Tantleff said.

Climate change is driving up insurance costs

The past year's inflationary pressures were felt in not only wages and supplies, but insurance claims.

As the cost of facilities and equipment has risen, it's also driven up the price of disruption downtime and interruption losses filed for insurance claims, said Brett Hoopingarner, director of underwriting at Sentry Insurance.

As manufacturers prepare their insurance budgets for 2024, Hoopingarner encouraged companies to work with their provider to review their property limits. This can help ensure that a company's policy can cover the full scope of possible reconstruction costs, taking into account recent inflation.

"We have seen, really since the end of 2019, reconstruction costs are up over 40% during that time," Hoopinger said. "If a manufacturer has not kept up, on an annual basis, reviewing those limits and making sure that the buildings are adequately insured, then unfortunately the time they usually find out is if they have a loss, and that's not the time you want to find out you're underinsured."

"If a tornado is going to come through and rip up your building, there's nothing you can do to stop that. It's just a fact of the matter. But what you can do is have a good continuity plan in place if that happens.”

Brett Hoopingarner

Director of Underwriting, Sentry Insurance

As the threat of climate change and extreme weather continues to grow, companies also need to account for greater possible storm destruction costs. This could include increasing the amount of interruption time covered by insurance, rather than simply a dollar amount.

Tornadoes, flooding and other disasters are hitting greater swaths of the country, putting more facilities at risk. In 2022, the U.S. experienced 18 separate billion-dollar weather disasters; the annual average between 1980 and 1922 was 7.9 events, according to the National Oceanic and Atmospheric Administration.

To mitigate those higher possible interruption costs, Hoopinger encourages companies to get facilities, particularly roofs, inspected and reinforced in advance.

"If a tornado is going to come through and rip up your building, there's nothing you can do to stop that. It's just a fact of the matter," Hoopingarner said. "But what you can do is have a good continuity plan in place if that happens.”